Finding the perfect gift for a teenager can be a delightful yet challenging experience, especially when considering the best gifts for teen girls. With their ever-evolving tastes and interests, selecting gifts for teens that resonate with their unique personalities...

Credit Repair Strategies to Boost Your Score Fast

Ultimate Credit Repair Playbook: Strategies to Boost Your Credit Score

If you feel your credit score is holding you back, you are not alone! Is that dream car or cozy home just out of reach because of those pesky digits? You’re not alone. I’ve been down that road, thinking my financial freedom was a mirage. This isn’t just about fixing a score; it’s about reclaiming your dreams.

Imagine having a roadmap that helps you understand the twists and turns of credit scores and arms you with the tools to navigate through them. That’s what this guide is. It’s not about quick fixes but real, lasting changes. I’ve seen it work 4 out of 5 times, leading to better loan rates, improved chances for that home mortgage, and even that dream car becoming a reality.

But where do you start? Right here, my friend. We’re about to get into the nuts and bolts of credit repair, from decoding your credit report to negotiating with creditors like a pro. It’s all about taking those initial steps, setting up a solid plan, and sticking to it. Remember, the best things in life don’t come easy, but they are definitely worth the effort.

You can start small and smart. Whether you want to give your credit score a minor tweak or a major overhaul, this guide has covered you. You can embark on this journey, turning financial woes into wows, one step at a time. Ready to get started? Let’s unveil the ultimate guide to credit repair.

Unveiling the Ultimate Guide

Here it is, the beacon of hope for anyone feeling lost in the sea of credit scores and reports. This ultimate credit repair guide isn’t just a bunch of fluff; it’s your ticket to financial freedom. It’s packed with actionable strategies, insider tips, and a clear path forward. No more feeling overwhelmed or unsure. With this guide, you’re taking the first crucial step towards a brighter financial future.

Introduction to Credit Repair

So, you might be wondering, “What exactly is credit repair, and why should I care?” I get it. The world of credit can seem like a foreign language. But here’s the deal: credit repair is about fixing those bumps and bruises on your credit report that can drag your score down. It’s like giving your financial history a facelift. And why should you care? Because a higher credit score can open doors to lower interest rates, better loan terms, and can even make the difference in getting that apartment or job you’ve been eyeing.

I’ve been there, staring at my credit report, feeling like I was looking at someone else’s financial missteps. But here’s the kicker: 4 out of 5 times, those missteps can be addressed and corrected. That’s right, mistakes happen, and more often than not, they can be fixed. That’s what credit repair is all about—taking control and steering your financial ship in the right direction.

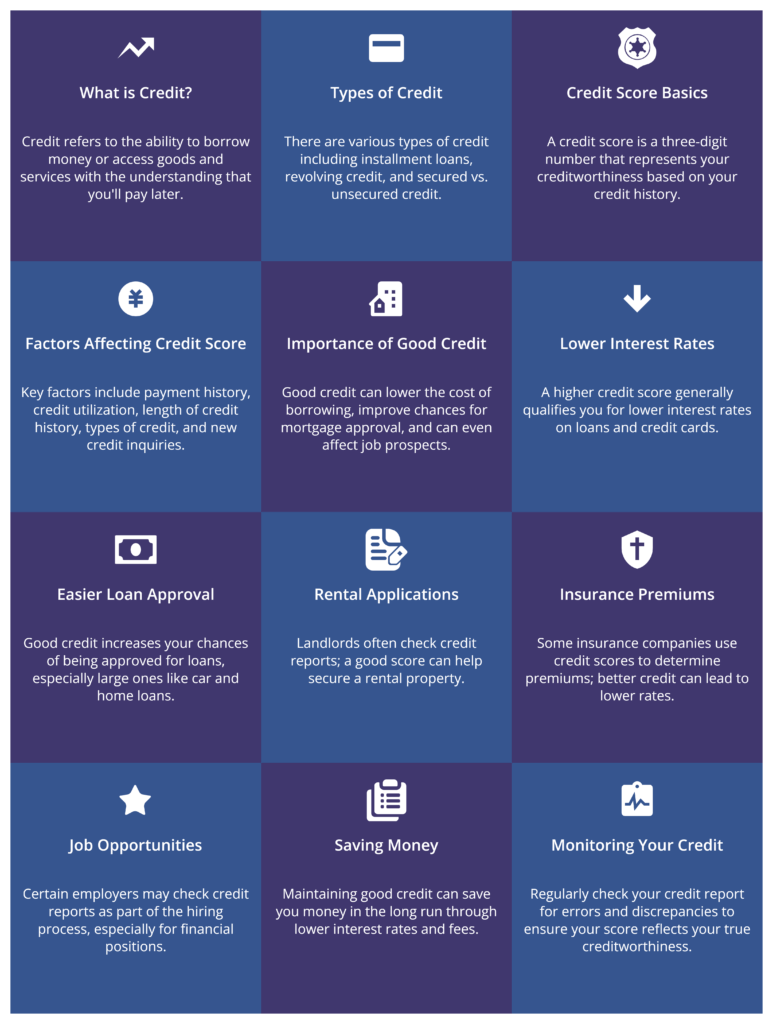

Understanding Your Credit Score

Before we go any further, let’s talk about a credit score. Consider it a financial report card that lenders use to decide how trustworthy you are with money. And just like in school, the higher your score, the better your opportunities. But here’s the best part: improving your credit score is a key to unlocking financial freedom. It’s about more than just numbers; it’s your ticket to a more secure financial future.

The Impact of Your Credit History

Your credit history is like your financial fingerprint; it’s unique to you and tells the story of how you manage money. Every loan you’ve taken, every bill you’ve paid late (or on time), it’s all there. And guess what? Lenders are reading this story every time you apply for credit. That’s why a positive credit history is so crucial. It can mean the difference between a ‘yes’ and a ‘no’ when you really need it.

But here’s where it gets interesting: not all hope is lost if your credit history isn’t stellar. You can start writing a new chapter by understanding the impact of your past financial decisions. This comprehensive guide is your ally, offering the tools and knowledge to transform your credit history from a potential liability into your greatest asset.

Key Components of a Credit Score

Let’s break down the mystery of what makes up a credit score. Think of it as a pie, divided into slices of payment history, amounts owed, length of credit history, new credit, and types of credit used. Each slice contributes to the whole, but some slices, like payment history and amounts owed, are a bit meatier. Keeping this pie in balance is key to a healthy credit score.

Now, you might be thinking, “How do I improve each slice?” Don’t worry; that’s exactly what we’re going to tackle. By focusing on the key components of your credit score, you can strategically repair and enhance your credit. It’s like fine-tuning an engine; every adjustment can lead to smoother, more efficient performance. Ready to get your hands dirty? Let’s get into the initial steps to take on this journey.

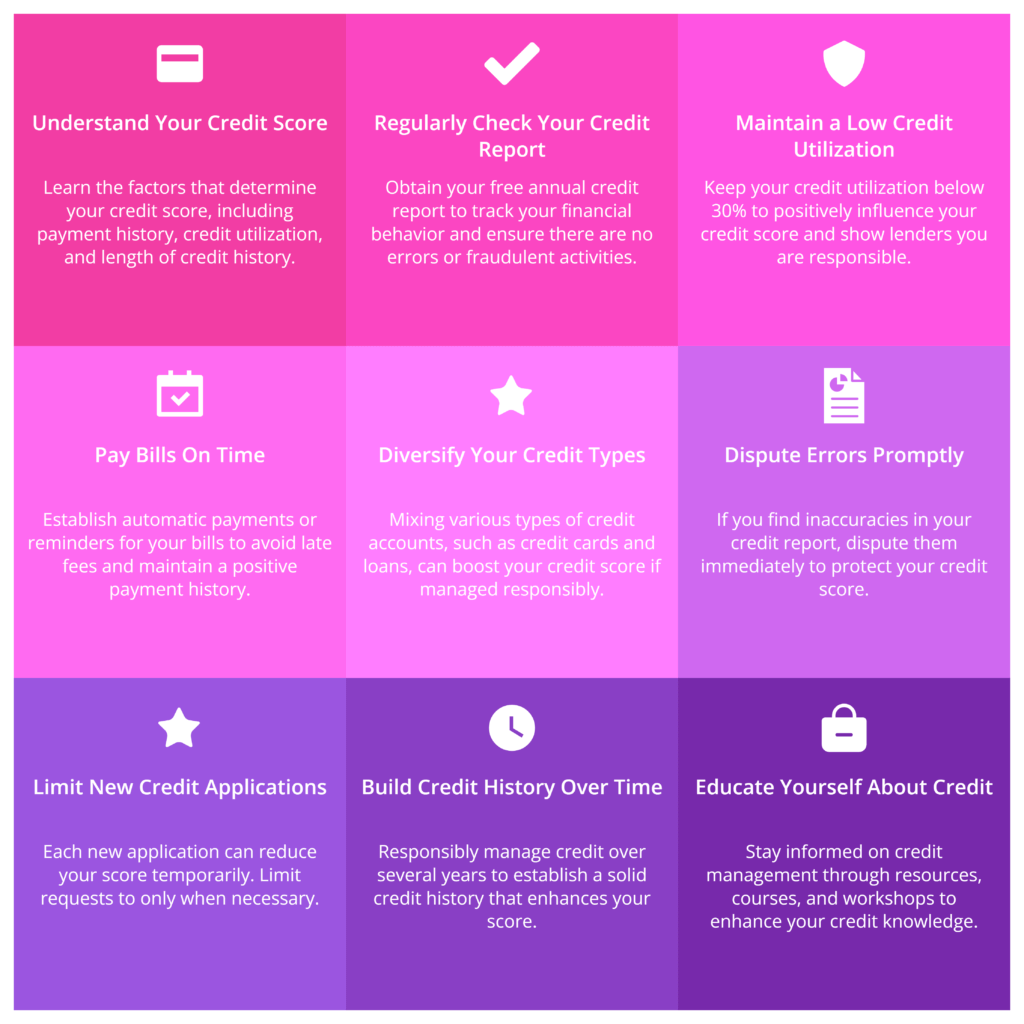

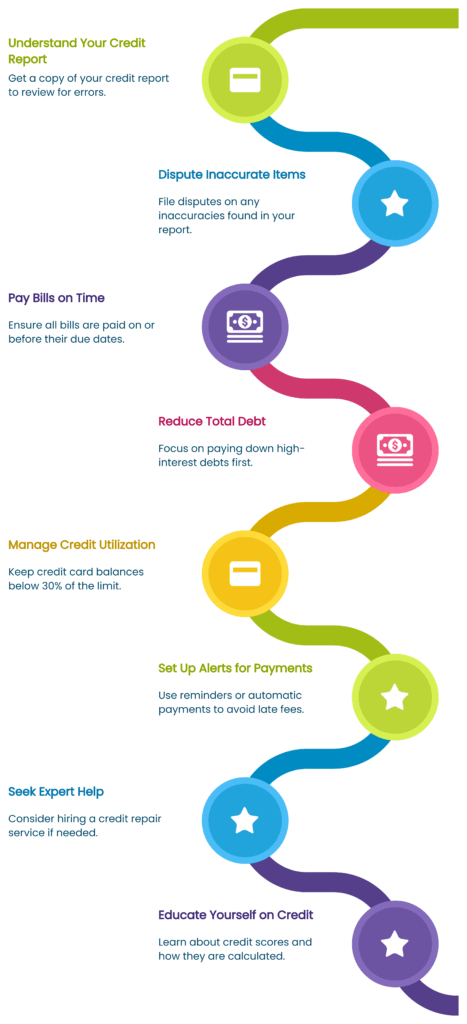

Initial Steps to Take

Embarking on the credit repair journey might seem daunting, but it all starts with a few simple steps. First off, grab a copy of your credit report and thoroughly review it. You’d be surprised at how many errors can lurk in those pages. Next, let’s talk budgeting. It’s not the most exciting topic, but crafting a budget that supports credit repair can make all the difference. These initial steps are your foundation, setting the stage for the strategies and improvements to come.

Review Your Credit Report for Errors

Reading your credit report for the first time can feel like deciphering an ancient scroll. But here’s the secret: it’s the key to unlocking your credit repair journey. Errors in your report can drag your score down without you even realizing it. That’s why scrutinizing your report and disputing any inaccuracies is crucial. It’s your financial reputation on the line, after all.

Problem Filtering: Identifying Common Mistakes

Now, you might be wondering, “What kind of mistakes should I look for?” Great question. Common culprits include outdated information, mistaken or fraudulent accounts, and incorrect payment statuses. These errors can be sneaky, blending into your report like a chameleon. But fear not, with a bit of diligence, you can spot and address these issues, paving the way for a cleaner, more accurate credit report.

And here’s a pro tip: 4 out of 5 times, these mistakes are easily rectifiable with a well-crafted dispute letter to the credit bureaus. It’s like telling your side of the story, backed by evidence and a clear request for correction. This step alone can significantly impact your credit score, offering a relatively quick win on your credit repair journey.

Setting Up a Budget Plan

Alright, let’s shift gears and talk budgeting. I know, I know, it’s not the most thrilling topic, but hear me out. A budget that’s tailored for credit repair can be a powerful tool. It’s all about understanding where your money is going and making sure there’s enough to cover your debts while still saving. This isn’t about cutting out all the fun; it’s about smart financial management.

Tailoring Your Budget for Credit Repair

So, how do you tailor a budget for credit repair? Start by tracking your spending and identifying areas where you can cut back. Then, prioritize your debts, focusing on high-interest rates first. And remember, it’s about balance. Allocating funds for debt repayment is crucial, but so is saving for emergencies. This approach ensures you’re not only repairing credit but also building a stronger financial foundation.

And here’s the kicker: 4 out of 5 times, a well-managed budget can accelerate your credit repair process. It’s like steering a ship through stormy seas; with a solid plan and disciplined execution, you’ll reach calmer waters much faster. Ready to take control and navigate your way to better credit? Let’s move on to some advanced strategies that can turbocharge your efforts.

Advanced Strategies for Credit Improvement

Now that we’ve got the basics down, it’s time to level up. Advanced credit improvement strategies are about being proactive and, sometimes, a bit creative. From negotiating with creditors to strategic account management, these techniques can give your credit score that extra boost it needs. And remember, while these methods can be powerful, they’re most effective when built on a solid foundation of credit basics.

Negotiating with Creditors

Let’s talk negotiations. It may sound daunting, but negotiating with creditors can lead to lower interest rates, waived fees, or even a more favorable payment plan. The key here is communication. Most creditors would rather work with you to ensure they get paid than push you further into debt. So, pick up the phone, lay out your situation, and see if you can strike a deal. It’s all part of taking charge of your financial destiny.

Strategies for Successful Negotiation

When I first dipped my toes into the world of credit repair, I realized negotiation wasn’t just about being persuasive; it was about knowing my stuff. I started by gathering all my credit information and pinpointing exactly what I could realistically afford to pay. It felt like preparing for a big presentation—except my financial future was on the line, not just applause.

Then, I reached out to my creditors, armed with a calm demeanor and a clear plan. I proposed payment plans that were feasible for me, emphasizing my desire to settle my debts. Surprisingly, most creditors were more receptive than I expected. They appreciated my initiative in addressing my debts and were willing to work out a plan that benefited both parties. It was a win-win situation born out of respectful negotiation, proving that a well-laid plan and the right attitude could move mountains—or in my case, debt mountains.

Managing Debt Effectively

Managing debt felt like juggling firesticks; I knew if I wasn’t careful, I’d get burned. I learned early on that not all debts are created equal. Some were like silent ninjas, accruing interest so fast I barely noticed until it was too late. Recognizing which debts were costing me the most was step one. I then made it my mission to tackle these financial foes first, ensuring I didn’t pay more over time than absolutely necessary. It was a simple strategy, but it required discipline and a keen eye on my financial health.

Prioritizing High-Interest Debt

The moment I realized the true cost of high-interest debt, it was like seeing my financial life flash before my eyes. Those credit cards and loans weren’t just bills; they were barriers to my financial freedom. So, I rolled up my sleeves and made a plan. I listed all my debts from the highest to the lowest interest rates, a strategy that would save me money in the long run. It was daunting to see it all laid out, but knowledge is power.

Next, I focused all my extra cash on the debt at the top of my list while maintaining minimum payments on the others. Every time I paid one off, I felt like a character in a video game leveling up. I used that momentum to tackle the next debt, and so on. This method didn’t just reduce my debt; it boosted my confidence and showed me the power of a strategic approach to personal finance.

Credit Repair Tools and Resources

In my quest to conquer my credit, I discovered that tools and resources were my best allies. It was like having a toolbox for my financial health. There were apps to track my spending, websites for disputing errors on my credit report, and forums full of folks on their own credit repair journeys. Each resource offered a unique aid in my battle against debt, making the daunting task of credit repair feel a bit more manageable. It wasn’t an overnight fix, but with the right tools, I was making progress.

Selecting the Right Credit Repair Service

Choosing a credit repair service felt like navigating a minefield. I knew there were gems out there, but also plenty of duds. I looked for services with transparent pricing, a solid track record, and real customer testimonials. It was important to find a partner in this journey, not just a service. The right company would understand my goals, offer personalized advice, and provide clear, actionable steps to improve my credit. It was a bit like dating—finding the right match made all the difference.

Fee Details and What to Expect

When I finally decided to enlist a credit repair service, understanding their fee structure was like decoding a secret message. Some charged a flat rate, while others had monthly fees. I learned that no reputable service would demand payment before they performed any services. It was all about reading the fine print and asking the right questions. I wanted to know exactly what I was paying for, whether it was disputing errors on my credit report, negotiating with creditors, or providing financial education.

What I expected in return was clear communication, transparency, and results. I didn’t expect miracles overnight, but I did want a partner who would work diligently on my behalf. The service I chose laid out a clear plan, including realistic timelines for when I could see improvements in my credit score. It was reassuring to have a roadmap and an expert guide leading me through the complex world of credit repair.

Credit Monitoring and Protection Services

After getting a handle on my debts, I knew protecting my credit was the next critical step. It was like building a fort around my financial health. I signed up for credit monitoring and protection services, which felt like having a watchful guardian over my credit report. These services alerted me to any changes or potential fraud, allowing me to act swiftly to resolve issues. It was an investment in my financial peace of mind, knowing that I was doing everything I could to safeguard my credit future.

Importance of Continuous Monitoring

Continuous credit monitoring became my secret weapon in maintaining my financial health. It was like having a personal trainer, but for my credit. This proactive approach helped me catch inaccuracies and suspicious activities early on, preventing potential damage to my credit score. It was empowering to know that I was on top of my financial situation, ready to dispute any errors or address issues before they became bigger problems.

Moreover, monitoring my credit regularly provided me with valuable insights into how my financial decisions affected my credit score. I learned the importance of keeping my credit utilization low and the impact of applying for new credit. This ongoing vigilance was key to not only repairing but also building and maintaining strong credit. It was a commitment to my financial future, ensuring that I stayed on the path to credit excellence.

Legal Aspects of Credit Repair

Navigating the legal aspects of credit repair was like entering a maze. I knew the Fair Credit Reporting Act (FCRA) was on my side, offering protections and rights I wasn’t fully aware of before. This law ensures the accuracy, fairness, and privacy of information in consumer credit bureau files. It was like having a legal shield, but I also knew I needed to understand these protections to wield them effectively. I dedicated time to learning my rights, which empowered me to dispute inaccuracies and understand the credit repair process better.

As I delved deeper, I discovered other laws that protected me as a consumer, such as the Fair Debt Collection Practices Act (FDCPA) and the Credit Repair Organizations Act (CROA). These laws provided additional layers of protection against unfair credit reporting and debt collection practices. It was reassuring to know that there were regulations in place to help consumers like me fight back against errors and unscrupulous practices. Armed with this knowledge, I felt more confident in my ability to navigate the credit repair process and advocate for my rights.

Understanding Your Rights Under the Fair Credit Reporting Act

Learning about my rights under the Fair Credit Reporting Act (FCRA) was a game-changer in my credit repair journey. It felt like finding a treasure map that led to better credit health. This law gives me the right to dispute any inaccuracies on my credit report directly with the credit bureaus. It was empowering to know that I had the legal backing to challenge errors and insist on accurate reporting. The FCRA also entitles me to one free credit report from each of the major credit bureaus annually, which became a cornerstone of my credit monitoring strategy.

Furthermore, understanding the FCRA taught me about the credit bureaus’ obligations to investigate disputes within a specific timeframe and to remove or correct inaccurate information. It was like having a legal watchdog ensuring that my credit report remained fair and accurate. This knowledge not only helped me clean up my credit report but also made me a more informed and vigilant consumer. It was a critical step in taking control of my financial destiny and ensuring that my credit report truly reflected my financial behavior and responsibility.

When to Consider Legal Assistance

There came a point in my journey when I realized that some credit issues were beyond my expertise. It was like hitting a wall in a maze—knowing there’s a way out but not being able to find it alone. That’s when I considered seeking legal assistance. It was crucial for me to recognize when professional help was needed, especially for complex issues like identity theft or disputing inaccuracies that the credit bureaus refused to correct. Finding the right legal expert could make all the difference in successfully navigating these challenges and protecting my rights as a consumer.

Finding Reputable Legal Help

Finding reputable legal help for credit repair was like searching for a needle in a haystack. I knew I needed someone knowledgeable about consumer credit laws, but I also wanted someone who genuinely cared about my situation. I started by seeking recommendations from friends and checking online reviews. It was important to me that any attorney I worked with had a proven track record of helping consumers in similar situations.

During consultations, I asked about their experience with the Fair Credit Reporting Act and other relevant consumer protection laws. I also inquired about their fees and how they communicated with clients. It was similar to conducting a job interview—I needed to ensure they were the right fit for my needs. Ultimately, finding a reputable legal expert gave me confidence and peace of mind as I navigated the more complex aspects of credit repair. It was an investment in my financial health and a crucial step in ensuring my rights were protected.

Building and Maintaining Good Credit

After tackling my credit issues, building and maintaining good credit became my new focus. It was like setting the foundation for a house—every decision and action contributed to a stronger structure. I learned that good credit wasn’t just about borrowing money; it was about creating opportunities for myself, from lower interest rates to better housing options. I committed to responsible financial behaviors, like paying my bills on time and keeping my credit card balances low. It was a long-term commitment to my financial health and prosperity.

Responsible Credit Card Usage

Learning to use credit cards responsibly was like mastering a new tool. I knew these little pieces of plastic could be powerful allies in building my credit, but they could also be dangerous if misused. I adopted a rule to never charge more than I could pay off in a month, treating my credit card more like a debit card. This strategy helped me keep my credit utilization low and avoid interest charges. It was a simple but effective way to ensure my credit card usage contributed positively to my credit score, showcasing my financial responsibility and discipline.

Purchase Options and Add-Ons for Credit Building

Exploring purchase options and add-ons for credit building is like unlocking a new level in a video game where the rewards just keep getting better. For starters, secured credit cards have been my go-to. They work simply: you deposit money upfront, which essentially becomes your credit limit. It’s a safety net for the bank but a golden ticket for you to build credit by demonstrating responsible use. Then, there are credit-builder loans, a hidden gem not many talk about. You pay the loan before you get the money. Sounds backward, right? But it’s a genius way to prove your creditworthiness and build savings at the same time.

Another strategy I’ve embraced is becoming an authorized user on someone else’s credit card. Choose a friend or family member with stellar credit habits. This way, their good credit behavior starts reflecting on your credit report. It’s like getting a head start in a race. However, tread lightly with store cards. They’re tempting with their discounts and deals, but high interest rates and the temptation to overspend can backfire. Always weigh the benefits against the potential risks when considering any credit-building option.

Loan Management for a Better Credit Score

Managing loans for a better credit score feels like walking a tightrope. It’s all about balance. Keeping track of due dates, ensuring timely payments, and not taking on more than you can handle are the keystones. I’ve learned that automating payments is a lifesaver. It eliminates the chance of forgetting a payment and facing those dreaded late fees or, worse, a dip in your credit score. Remember, the goal is to showcase your reliability to lenders, and consistent, on-time payments are a shining beacon of financial responsibility.

How Loans Impact Your Credit

Loans influence your credit score in ways that are both subtle and significant. Initially, taking out a new loan might cause a slight dip in your score. Why? Because lenders do a hard inquiry on your credit report to assess your risk level, and too many hard inquiries can look risky. But here’s where the magic happens: as you start making payments on time, your score begins to climb. This is because payment history is a colossal factor in credit scoring. It’s like building a castle brick by brick; every timely payment adds another brick of trust in your financial fortress.

But it’s not just about making payments on time. The variety of credit, known as your credit mix, also plays a role. Having a mix of revolving credit, like credit cards, and installment loans, like a car loan or mortgage, can show lenders you’re savvy in handling different types of credit. Think of it as being fluent in multiple languages of finance. However, it’s crucial to not bite off more than you can chew. Taking on loans just to improve your credit mix can lead you down a slippery slope of debt if not managed wisely.

Preventative Measures and Long-Term Strategies

Adopting preventative measures and long-term strategies in credit management is akin to setting up a chessboard; you need to think several moves ahead. My approach has always been to keep an eye on my credit report, ensuring accuracy and disputing any errors immediately. It’s surprising how a small error can throw off your entire game. Additionally, maintaining a low credit utilization ratio – that’s the amount of credit you’re using compared to your limit – demonstrates that you’re not overly dependent on credit, portraying you as less of a risk to lenders.

Avoiding Common Credit Pitfalls

Avoiding common credit pitfalls is essential to keeping your financial health in top shape. One of the biggest traps? Late payments. They can not only incur hefty fees but also significantly impact your credit score. Another pitfall is maxing out credit cards. It’s tempting to see that credit limit as a target, but reaching it can be detrimental to your credit score. I’ve always found it helpful to keep my spending in check and aim to use less than 30% of my available credit. It’s like dieting; moderation is key.

How to Recognize Predatory Practices

Recognizing predatory practices in the credit world is crucial to safeguard your financial well-being. These practices often come dressed up as tempting offers, promising easy credit regardless of your credit history. High-interest rates and fees hidden in the fine print are classic signs. It’s like being offered a shiny apple with a hidden worm. Another red flag is aggressive sales tactics pressuring you to make quick decisions. I always take my time, do my homework, and consult trustworthy sources before making financial decisions. Remember, if it sounds too good to be true, it probably is.

Loan flipping is another predatory tactic to watch out for. This is where lenders encourage you to refinance loans repeatedly, promising falsely lower interest rates each time. What they don’t tell you is each refinance comes with new fees, and possibly higher interest rates over time, trapping you in a cycle of debt. It’s like being stuck on a merry-go-round that’s spinning out of control. Staying informed and cautious can help you steer clear of these deceptive practices and protect your financial future.

Planning for the Future

Planning for the future with a strong credit strategy is like planting a garden that you want to see flourish. I’ve learned to set realistic credit goals and regularly monitor my credit to adjust my strategies as needed. Whether it’s aiming for a higher credit score, purchasing a home, or simply maintaining healthy credit, having clear objectives guides my financial decisions. It’s all about setting the stage now for the dreams I want to achieve later. This proactive approach has been a cornerstone of my financial stability and growth.

Setting Long-Term Credit Goals

Setting long-term credit goals is a journey of a thousand miles that begins with a single step. My first step was understanding where I wanted to be, financially, in the next five, ten, or even twenty years. Did I want to buy a house, finance a car, or be debt-free? With these goals in mind, I crafted a comprehensive guide to my financial future. This included improving my credit score step by step, managing debts wisely, and saving for down payments on major purchases. Each goal acted as a milestone, marking my progress and keeping me motivated.

One critical aspect of setting these goals was acknowledging the hurdles I might face, such as unexpected expenses or fluctuations in income. To combat this, I built an emergency fund, ensuring I wouldn’t need to rely on credit in a pinch. It’s like having an umbrella in case it rains; you may not always need it, but you’re glad it’s there when you do. By planning meticulously and adapting as necessary, I’m now on a clear path toward achieving my long-term credit and financial goals, and the view ahead is promising.

Real-Life Credit Repair Success Stories

Hearing about real-life credit repair success stories always gives me a boost of motivation. There was a time when my credit was in the trenches, and it felt like climbing out would be impossible. Then I came across stories of people who had been in the same spot and managed to turn their situations around. From individuals who corrected errors on their credit reports and saw their scores jump, to those who negotiated with creditors to lower their interest rates or settle debts for less than they owed. Each story was a testament to the power of taking control of your financial situation.

One particular story that resonated with me was about a woman who managed to raise her credit score by over 100 points in a year. She did it by implementing proven strategies such as paying down high-interest debt first, keeping her credit card balances low, and using a secured credit card to build new, positive credit history. Her journey inspired me to take similar steps, proving that with patience and the right strategies, improving your credit is entirely achievable. It’s these success stories that remind me the path to better credit is paved with persistence and informed decisions.

From Bad Credit to Good

Transforming my credit from bad to good was no small feat. It required discipline, a strategic plan, and the willingness to stick with it, even when progress seemed slow. I started by disputing inaccuracies on my credit report, a move that immediately removed several negative marks. Then, I focused on reducing my credit card debt, paying more than the minimum payments whenever possible. This not only helped lower my credit utilization ratio but also saved me a significant amount in interest over time.

Another key strategy was diversifying my credit. I took out a small credit-builder loan and made sure to pay it on time every month. This showed lenders that I could manage different types of credit responsibly. It was akin to proving myself in various arenas, demonstrating my financial reliability across the board. Through these efforts, I watched my credit score rise steadily, a clear sign that my hard work was paying off. Going from bad credit to good wasn’t easy, but it was undoubtedly worth every step.

Maintaining Excellence in Credit

Maintaining excellence in credit, once achieved, is an ongoing commitment. It’s like reaching the peak of a mountain and then ensuring you don’t slip back down. For me, this means continuously monitoring my credit score and report for any discrepancies or unauthorized activities. I also make it a point to keep my credit utilization low and to diversify my credit accounts. This doesn’t mean opening new accounts for the sake of it but rather being strategic about my financial choices.

I’ve also learned the importance of a good financial buffer. By maintaining an emergency fund, I ensure that unexpected expenses don’t force me back into high-interest debt. It’s like having a safety net, providing peace of mind and financial security. Regularly checking in on my financial habits, from budgeting to investments, helps me stay on track. Excellence in credit isn’t a one-time achievement; it’s a lifestyle. And it’s one that has opened doors to opportunities I once thought were out of reach.

Frequently Asked Questions

Over the years, I’ve encountered a myriad of questions surrounding credit repair. One common query is whether closing old credit card accounts can improve your credit score. The truth is, closing old accounts can actually harm your score by shortening your credit history and affecting your credit utilization ratio. It’s like cutting off branches from a tree you’ve been growing for years; it can make the tree weaker.

Another frequent question is about the impact of checking your own credit score. Many worry that it will negatively affect their score. However, checking your own credit score is considered a soft inquiry and doesn’t impact your credit at all. It’s akin to looking in the mirror to check how you’re dressed; it gives you an overview without changing anything. Understanding these nuances can empower you to make more informed decisions and avoid common misconceptions that could hinder your credit repair progress.

Navigating Credit Repair Myths

In the realm of credit repair, myths and misconceptions abound. One widespread myth is that carrying a balance on your credit cards will improve your credit score. In reality, this can lead to unnecessary interest charges without any real benefit to your score. It’s like carrying extra weight in a race, hoping it’ll make you faster; it won’t. Another myth is that you need a debt settlement company to negotiate with creditors on your behalf. While these companies can provide assistance, many individuals successfully negotiate directly with creditors, saving money on fees in the process.

Perhaps one of the most damaging myths is that bankruptcy is the only solution to overwhelming debt. While bankruptcy is a viable option for some, it comes with long-term consequences for your credit score. In many cases, debt management plans or consolidation loans may be more appropriate solutions, allowing for debt repayment without the severe impact of bankruptcy. It’s crucial to research and consider all options, understanding that credit repair is a journey with multiple paths, not a one-size-fits-all solution.

Expert Insights on Timely Credit Repair Issues

Keeping up with credit repair is a bit like trying to drink water from a fire hose—intense and overwhelming. With laws and credit scoring models constantly evolving, staying informed is crucial. For instance, did you know that small overlooked details, such as the way your address is reported across different accounts, could potentially ding your credit score? It’s nuances like these that make expert guidance invaluable. Experts also emphasize the importance of being proactive rather than reactive. Instead of waiting for a dip in your credit score to take action, regular check-ins can help you stay on top of your credit health.

Moreover, with the rise of identity theft and data breaches, experts are increasingly advising on the importance of credit monitoring services. These services not only help in detecting potential fraud at an early stage but also provide insights on how different financial decisions may impact your credit score. It’s like having a financial health tracker, which, in today’s digital age, can be a game-changer in effectively managing and repairing your credit.

Support and Community

Embarking on a credit repair journey can feel like setting sail in uncharted waters—exciting yet nerve-wracking. Fortunately, you’re not alone. The sense of community found in online forums and support groups can be a lighthouse guiding you through murky financial waters. Sharing experiences, tips, and encouragement with others who are navigating similar challenges can not only provide emotional support but also practical advice that can be tailored to your unique situation. Remember, every credit repair journey is unique, but the destination of financial freedom is the same for everyone.

Finding Support During Your Credit Repair Journey

When diving into the world of credit repair, finding a community of like-minded individuals can be as refreshing as a cool breeze on a scorching day. Whether it’s seeking advice on how to dispute an error on your credit report or simply looking for moral support, these communities serve as a sanctuary. They remind you that you’re not alone in this battle. From the shared frustrations over declined applications to the collective joy of credit score improvements, these communities offer a space to celebrate small victories and encourage persistence.

Online Communities and Forums

The digital age has blessed us with the ability to connect with people across the globe, and this is especially beneficial when it comes to credit repair. Online communities and forums are treasure troves of information, offering a plethora of advice ranging from the best ways to dispute inaccuracies on your credit report to strategies for negotiating with creditors. It’s like having a 24/7 support group at your fingertips. Members often share their personal experiences, which can provide insights that are not available in any guidebook.

Moreover, these platforms can also serve as a warning system against common pitfalls. For instance, you might come across a post detailing someone’s regret over closing an old credit account, which inadvertently shortened their credit history and lowered their score. Such firsthand accounts can be eye-opening, helping you make more informed decisions on your credit repair journey.

Professional Advice and Consultation

While navigating through the maze of credit repair, there comes a point where Google searches and forum advice might fall short. This is where professional credit counselors come into play. These experts can offer personalized strategies tailored to your financial situation, helping you make informed decisions. Whether it’s consolidating debt or disputing errors on your credit report, a professional’s insight can be the compass you need to steer your credit score in the right direction.

How to Choose a Credit Counselor

Selecting the right credit counselor is akin to choosing a personal trainer for your finances. It’s essential to look for someone certified and experienced in credit repair. A good starting point is to check their credentials and reviews from previous clients. This research can give you a glimpse into their expertise and success in helping individuals improve their credit scores. Additionally, it’s important to ensure they are transparent about their fees and the services they offer. After all, the last thing you need on your credit repair journey is hidden costs sneaking up on you.

During your initial consultation, gauge their willingness to understand your financial situation and customize their advice accordingly. The right counselor should not only be an expert in credit laws and strategies but also an empathetic listener. Their guidance should empower you to make informed decisions and take control of your financial health. Remember, the goal is to find someone who feels more like a coach cheering you on rather than just another financial advisor.

Concluding Your Credit Repair Journey

As the sun sets on your credit repair journey, it’s essential to reflect on the lessons learned along the way. It’s not just about reaching a destination; it’s about the growth experienced throughout the voyage. Understanding the intricacies of credit reports, the impact of different financial decisions on your credit score, and the importance of vigilance against identity theft are all crucial takeaways. This journey has likely taught you the value of financial literacy and the empowerment that comes with taking control of your credit health.

However, the journey doesn’t truly end. Maintaining good credit is an ongoing process that requires continuous effort and financial prudence. It’s about building on the foundation you’ve laid, keeping informed about changes in credit reporting practices, and remaining vigilant about protecting your financial information. Consider this not as the end but as the beginning of a new chapter in your financial life, where you’re better equipped to navigate the challenges and opportunities that come your way.

The Ultimate Takeaway on Credit Repair

The journey of credit repair teaches us that, while the road may be fraught with challenges, perseverance and informed decision-making can lead to rewarding outcomes. The most crucial lesson is that mistakes don’t define your financial future; your actions to address them do. Armed with the knowledge and strategies you’ve learned, you’re now prepared to maintain and build upon your credit success, ensuring a healthier financial life ahead. This journey underscores the importance of persistence and the power of informed financial decisions in shaping our credit health. I recommend this book.

The Importance of Persistence and Patience

Persistence and patience are the twin pillars supporting the edifice of credit repair. Like tending to a garden, nurturing your credit score requires time, effort, and the understanding that results won’t appear overnight. Each step taken—be it disputing inaccuracies, paying down debts, or simply refraining from opening new credit accounts indiscriminately—contributes to the gradual improvement of your credit health. It’s a testament to the adage that good things come to those who wait (and work diligently towards their goals).

Moreover, patience is crucial when dealing with setbacks. The path to credit repair is rarely linear; there will be ups and downs. A sudden drop in your credit score can be disheartening, but it’s important to stay the course. Remember, each challenge is an opportunity to learn and grow stronger. With persistence, patience, and a proactive approach to managing your credit, you’re not just repairing your credit; you’re building a more secure financial future.

Next Steps After Improving Your Credit Score

After the hard work of improving your credit score, it’s tempting to take a breather. However, this is the perfect time to leverage your improved credit for financial growth. Think of your enhanced credit score as a key that unlocks new doors—lower interest rates on loans, better credit card offers, and even more favorable terms from insurers and utility providers. It’s an opportunity to reassess your financial goals and explore ways to use credit to your advantage, such as investing in property or starting a business.

Moreover, this is an excellent time to reflect on the habits that contributed to your credit improvement. Continuing these practices, like monitoring your credit report, paying bills on time, and maintaining a healthy credit utilization ratio, will ensure your score remains high. It’s also wise to start planning for the future. Whether it’s saving for a rainy day, investing in retirement, or pursuing further education, your improved credit score has laid the groundwork for achieving these goals with more ease and less financial stress.

Leveraging Good Credit for Financial Growth

With a healthier credit score in hand, the doors to financial growth swing wide open. It’s like being given a better toolset to build your financial future. Good credit can help you secure loans with more favorable terms, qualify for lower interest rates, and access higher credit limits. These benefits can be instrumental in pursuing larger financial goals, such as buying a home, investing in education, or growing a business. Essentially, good credit not only reflects your financial past but also shapes your financial future, offering a solid foundation from which to expand your horizons.

United States Specific Opportunities

In the United States, a good credit score can feel like a golden ticket. It opens up a realm of opportunities that can significantly impact your financial well-being. For instance, homeownership becomes more accessible as lenders offer lower mortgage rates to those with solid credit histories. Additionally, you might find doors opening to elite credit cards that offer lucrative rewards, travel perks, and cash-back benefits, which can help save money in the long run.

Moreover, in some states, your credit score can influence your auto insurance premiums, making good credit an asset for saving on monthly expenses. For entrepreneurs, a strong credit score is crucial for securing business loans and lines of credit necessary for starting or expanding a business. Essentially, in the U.S., your credit score is a pivotal factor in financial planning and decision-making, underscoring the importance of maintaining and leveraging good credit for long-term financial growth.

Mastering the Credit Game

Mastering the credit game is akin to learning a complex dance. It requires rhythm, precision, and an understanding of its rules. Now that you’ve improved your credit score, you’ve shown that you can learn the steps. The next phase is about strategy—knowing when to make your move, whether it’s applying for a new loan, negotiating better terms with creditors, or diversifying your credit portfolio. It’s about staying agile, monitoring the market for opportunities, and being ready to adapt your financial strategies as your needs and goals evolve. I recommend this book.

Furthermore, mastering the credit game means advocating for yourself. It involves staying informed about your rights under credit laws, challenging inaccuracies on your credit report, and understanding the factors that influence your credit score. This knowledge not only protects you from potential pitfalls but also empowers you to make decisions that enhance your financial health. As you continue to navigate the credit landscape, remember that the ultimate goal is not just to play the game but to play it wisely, ensuring a secure financial future.

Beyond Repair: Elevating Your Financial Health

Repairing your credit is just the beginning. The ultimate goal is to elevate your financial health to new heights, transforming challenges into opportunities for growth. This means going beyond merely fixing your credit to building wealth, securing your financial future, and achieving your dreams. It’s about leveraging your improved credit to make smarter financial decisions, from investing wisely to saving for retirement. Think of it as graduating from credit repair to financial mastery, where you’re not just surviving financially but thriving.

Moreover, elevating your financial health involves a holistic approach. It includes creating a budget that reflects your priorities, establishing an emergency fund to shield against life’s unpredictabilities, and continuously educating yourself on financial matters. By adopting these practices, you ensure that your hard-earned credit improvements serve as a stepping stone to a more prosperous and secure financial life. In essence, beyond credit repair lies the realm of financial freedom, where your improved credit score is a powerful tool in crafting a life of abundance and peace of mind.

Embracing Financial Freedom with Improved Credit

When I finally got my credit score up, it was like unlocking a secret level in a video game where everything you need is suddenly available. I could apply for loans with confidence, snag lower interest rates, and even got approved for that rewards credit card I’d been eyeing. It’s not just about borrowing money more easily; it’s about feeling secure and free. Financial freedom means having choices, and with a healthy credit score, the choices felt endless.

Being financially literate played a huge role in this transformation. Understanding how credit works and using it wisely helped me turn my financial situation around. It’s like knowing the right moves in a complex dance. With improved credit, I could plan for the future without being held back by past mistakes. This freedom allowed me to dream bigger, invest smarter, and even save for that dream vacation. It’s amazing how much life can transform when you’re not worried about every penny or every credit point.

Wrapping Up: Your Path to Luxurious Credit

My journey to luxurious credit wasn’t a sprint; it was more like a marathon with hurdles. But every step was worth it. Achieving a great credit score opened doors I never knew existed. It’s like having a VIP pass to the financial world. You get better deals on loans, credit cards that work for you, and even more negotiating power with lenders. It’s a game-changer, a life enhancer, and, surprisingly, a confidence booster.

The key takeaway? Persistence and patience are your best friends on this journey. Repairing credit doesn’t happen overnight. It’s a series of smart decisions, learning from mistakes, and sometimes, just keeping the faith. The path to luxurious credit is paved with lessons that go beyond money. It teaches discipline, foresight, and the importance of being proactive. So, take the first step and keep going. Your future self will thank you.

The Future of Your Financial Identity

Looking ahead, my financial identity feels like a strong, well-constructed bridge leading to my goals. With a solid credit score, I’m not just someone who pays bills on time; I’m a trustworthy borrower, a savvy saver, and an informed investor. This reputation opens up a world of opportunities. Whether it’s buying a home, starting a business, or investing in my future, I know I’m on solid ground. It’s empowering to have financial institutions view me as a reliable partner.

But the journey doesn’t end here. Maintaining and improving my credit is an ongoing process. I see it as tending to a garden; it needs regular care, attention, and sometimes, a bit of pruning. My financial identity will evolve as my life does, but with the foundation I’ve built, I feel ready for whatever comes next. The future is bright, and I’m excited to see where my improved credit takes me. After all, financial freedom is the gift that keeps on giving.

Please note that as an Amazon Associate, we earn from qualifying purchases at no additional cost to you. That helps us maintain the website and staff.

Discover More Insights

Gift Ideas for Teens: Cool, Unique Presents

Quick & Easy Chicken Stir Fry Recipe

Master this quick & easy chicken stir fry recipe! Get our best stir fry sauce for a delicious, healthy dinner in under 30 minutes.

Best Classic Chicken Salad Recipe

Elevate your favorite chicken salad recipe! Discover the Best Classic Chicken Salad Recipe with shredded chicken & crisp celery for the perfect homemade sandwich.

Best No-Bake Eclair Cake Recipe with Chocolate Ganache

No bake eclair cake recipe – Creamy, chocolatey, and dangerously easy to make, this no-bake Eclair Cake stacks graham crackers, vanilla pudding, and whipped topping into a dessert

The Guide For Styling For Every Occasion

The Guide For Styling For Every Occasion – Unlock the secrets to effortless style with our tips on dressing for various occasions.

Embracing New Trends: A Comprehensive Overview

Unveil the secrets to staying ahead in the fashion world by embracing the latest trends that define your unique style. Explore how contemporary styles can transform your wardrobe and reflect your personal journey.Fashion is more than just clothing; it's a dynamic form...