Credit Building for College Students: A Comprehensive Guide

Starting off in the world of credit is like playing a game where you want to earn points. These points are important for big goals, like buying a car or renting an apartment.

You already have a lot on your plate with classes and figuring out how to pay for Friday pizza. But building credit is a step you can’t skip. Managing credit cards and secured cards may feel challenging, but don’t worry; we have some helpful tips.

The Fundamentals of Building Credit for College Students

Start with the basics. If you have a credit card bill, make it your monthly goal to pay it on time. Secured cards are a good way to build your credit. By paying back money, you show banks you are responsible and ready for bigger things in the future. This is all part of managing your personal finances. I recommend this book.

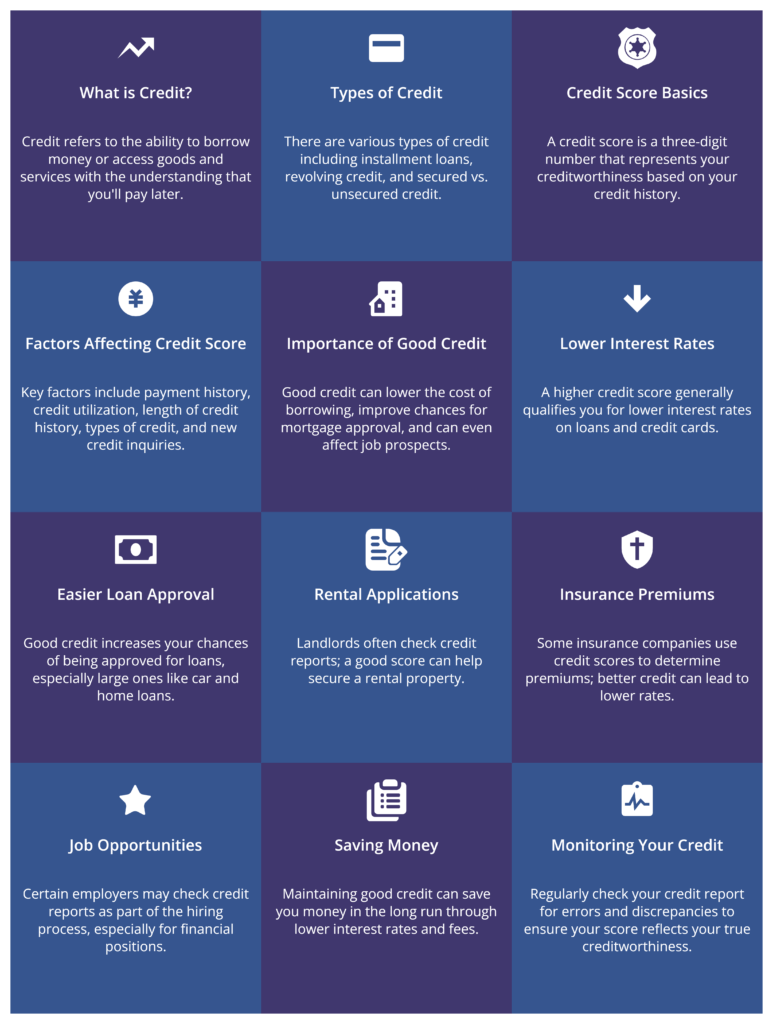

Understanding Credit and Its Importance

Having good credit is like having a VIP pass to the financial world. It helps you borrow money for big stuff later. Think of it like a trust score. The higher, the better.

What Is a Credit Score?

Imagine if every time you borrowed a toy, your friends kept a score of how good you were at giving it back. That’s a credit score. It tells banks how good you are at returning borrowed money.

Why Building Credit Early Matters

Starting early gives you a head start. It’s like planting a tree. The sooner you do it, the more shade you can chill under. Watching your score, making timely payments, and keeping what you owe low shows you’re the boss of your money.

Beginning Your Credit Journey

Ready to dive in? First steps first. Get a credit card that understands you’re learning.

1. Get a Secured Card or Student Credit Card

Student credit cards are like learner’s permits for borrowing. They help you safely build credit. Starting here lets you level up later. I recommend this book. Here are some institutions, and banks that may be helpful:

2. Become an Authorized User on a Parent’s Credit Card

It’s a bit like riding tandem on a bike. If your folks trust you, you can help pedal the credit-building journey together, but remember, any swerve affects both riders. You can have a card shared with your parents BUT that will not be a step towards building YOUR OWN CREDIT!

Key Strategies for Credit Building

Ready to level up? Think big but start small. Credit unions can be great allies. And if you’re eyeing an apartment, remember, timely payments can also help build your score.

Making Payments Work in Your Favor

Payments are your power moves. Paying on time can raise your score faster than a sprinter out of the blocks. And some bills even give you a grace period. Use it wisely.

3. Consistent On-Time Payments

Every on-time payment is like a gold star on your financial report card. It shows lenders that you are reliable and keep your promises.

4. Managing Student Loan Payments Early

Making even a small early payment on your student loans can be helpful. It gives you a better start, like arriving early at a party. I recommend this book.

Expanding Your Credit Horizons

Once you have the basics, it’s time to explore new territories.

5. Exploring Credit-Builder Loans

These loans are unique. They help you prove that you can make payments on time. This can help you build a strong credit score.

6. Leveraging Rent Payments to Build Credit

If you’re paying rent, you might as well get some credit for it, right? Some services let you add those payments to your credit history. It’s a win-win. I recommend this book.

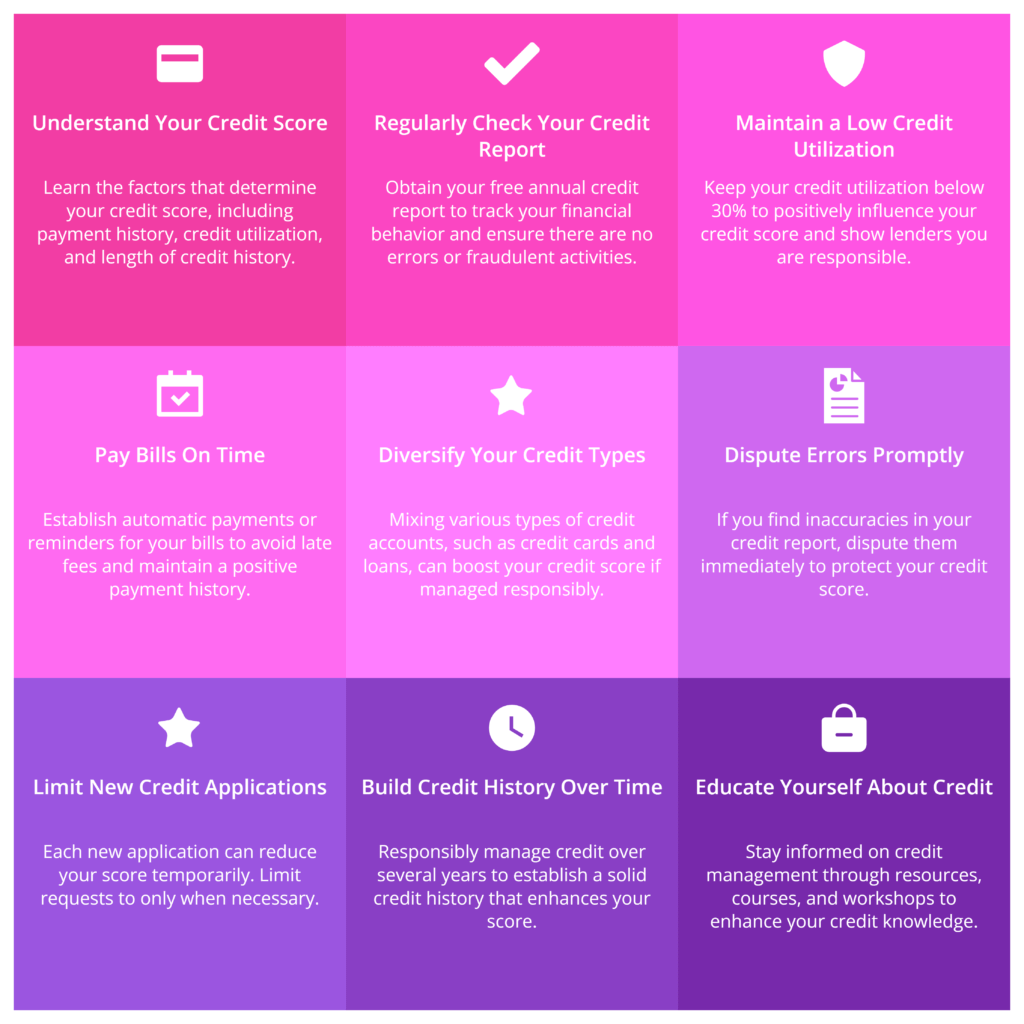

Monitoring and Protecting Your Credit

Keeping track of your credit stuff is like making sure nobody’s sneaking extra cookies from the jar. It’s important. You gotta make sure no one’s messing with your info or taking loans in your name. Just like you wouldn’t want someone taking your bike without asking, you don’t want folks messing with your credit.

Keeping an Eye on Your Credit Health

Imagine you have a garden. Checking your credit report is like checking your plants. You should do it regularly to ensure everything is healthy and there is no incorrect information.

7. Regularly Check Your Credit Report

So, checking your credit report is like doing a spy mission on yourself. It’s going through all the stuff banks and companies say about how you borrow and pay back money. You wanna do this at least once a year to catch any mistakes or, worse, someone pretending to be you. It’s free, so no excuses there!

8. Monitor Your Accounts for Suspicious Activity

It’s like being on neighborhood watch but for your money. Keep an eagle eye on your bank and credit card accounts. If you see a strange charge for 12 pizzas in a town you’ve never visited, it’s a warning sign. Report it quickly, or it’s like letting a thief take your money without permission.

Credit Mistakes to Avoid

Let’s talk oopsies that can make your credit score cry. Things like missing a bill payment or hitting up your credit card like it’s an unlimited candy store. Bad moves. They stick to your credit like gum on a shoe, hard to scrape off.

Common Pitfalls That Harm Credit Scores

Not all mistakes are the same, but some can seriously hurt your credit score. Think of it as tripping in a race; it will slow you down. Overspending, paying your bills late, or not keeping track of your credit can make banks hesitant to lend you money. Don’t let that happen to you.

The Impact of Late Payments

Being late might be fashionable at parties, but not with bills. If you ignore your credit score and say, “Sorry, I just didn’t feel like it,” your score will remember. It can drop quickly. Banks and lenders don’t like that. This makes it harder to borrow money in the future.

Advanced Credit Building Techniques

Once the basics are down, it’s like leveling up in a game. Time to boost that score with some pro moves. Think of it as adding superpowers to your financial profile. We’re talking stuff that makes lenders give you thumbs up even faster. I recommend this book.

Beyond the Basics: Enhancing Your Credit Profile

We are into the major leagues now. It is similar like getting a car instead of a bike. With some cutting-edge strategies that will have banks nodding in agreement, let us make your credit sparkle.

9. Becoming a Co-Signer: Risks and Rewards

When you co-sign a loan, you agree to help someone if they struggle to make payments. This means you say, “I will support you if things get tough.” However, if they miss payments, you are responsible too. Your credit score might go down if they do not make payments. So, think carefully about who you trust to take this step with you.

10. Consider a Student Credit Card for More Benefits

You might want to get a student credit card if you’re a student. It’s a good way to start learning about credit. These cards are designed for students and can help you build your credit score while keeping risks low. They also offer perks like cash back on pizza nights.

Utilizing Tools and Resources for Credit Management

Think of managing your credit like playing a video game. There are tools and power-ups out there to help you win. You must know where to find them and how to use them right.

Tech to Support Your Credit Journey

In the age of smartphones, keeping an eye on your credit is easier than finding a pizza place that delivers after midnight. Some apps and websites can help you track what’s going on with your credit. It’s like having a financial buddy in your pocket.

Apps and Websites to Monitor Your Credit

You can easily check your credit score using various apps whenever you want, just like checking the weather. These apps can alert you to any unusual activities, so you can address them quickly. Plus, most of them are free, which is always nice. There are budgeting apps Mint, YNAB, that can help you manage your budget to keep your expenses within your plans.

Secured Credit Card Options for College Students

Secured credit cards are a good starting point for building credit. You make a deposit, which serves as your credit limit. This helps show banks that you can manage money responsibly and can improve your credit score. They are ideal for students who want to focus on their studies while also building their financial future.

Professional Advice and Assistance

When you need to take control of your money, it’s time to get help. Financial advisors and credit counselors are the experts you can rely on. They help you understand credit and make better financial choices. It’s like having a money coach who can help you play the game smarter.

Seeking Guidance from Financial Advisors

Imagine you’re trying to learn how to play chess. You could figure it out independently, but it’d be much quicker if someone who’s been playing for years shows you the moves. That’s what a financial advisor does but with your money. They help you save and invest money so your cash grows quickly. They can also explain how to build a strong credit score. Having a good credit score is like having a high score in a video game, but for adults. One may use Credit Karma for your free credit score, report, and monitor your credit or even personalized recommendations for credit cards, loans, and insurance or help track your debt and learn how to pay it down.

Navigating Credit Counseling Services

Then you’ve got credit counseling services. Think of them as your personal financial trainers, but instead of getting you in shape for a marathon, they’re getting your credit score fit. They sit down with you, review your bills, and give you a plan that’s like a road map to debt-free. If you’re feeling swamped by bills, these are the folks to call. They can even talk to your creditors for you, which is like having a translator for money talk.

Preparing for Post-Graduation Credit Management

With its festivities and cap-throwing, graduation is a significant occasion. However, what follows? Your actual journey starts here. With your graduation in hand, you are ready to pursue your goals. Effective credit management is a major component of this. You must maintain equilibrium to prevent your credit score from dropping, much like when you go from a tricycle to a bicycle.

Transitioning to the Real World

Transitioning to the real world is like jumping from the kiddie pool to the deep end. It’s exciting but a tad bit scary. Suddenly, you’re dealing with bigger bills, maybe a car payment, or even thinking about a mortgage. It’s a lot, but that’s grown-up life for you. Keeping your credit in good shape is key to making those grown-up dreams come true.

Managing Credit After College

After you toss that graduation cap into the air, it’s time to get down to business with your credit. No more student discounts, now we’re talking full-price responsibility. This means keeping an eye on your credit score, paying those bills on time, and not letting your credit cards run wild. It’s all about balance – enjoy your newfound freedom but remember, with great power comes great responsibility to your credit score.

Adjusting from a Student to a Graduate Credit Card

Switching from a student credit card to a graduate card is like upgrading from a flip phone to a smartphone. You get better benefits and some rewards, but you also take on more responsibility. Make sure to read the fine print for any fees and interest rates that might catch you off guard. Use your credit card as a tool, not as free money, and you’ll be in good shape.

Frequently Asked Questions

Do you have questions? You’re not alone. We all wonder about things, like whether frogs have ears or how to build credit without a credit card. When it comes to credit, there are no silly questions—only the ones you don’t ask. Let’s explore some of your important questions.

Addressing Common Inquiries

Life’s full of questions. Like, why is the sky blue? Or more importantly, how do I make my credit score not suck? Well, you’re in the right place for that last one. Let’s tackle some common inquiries about building that all-important credit.

Can You Build Credit Without a Credit Card?

Building credit without a credit card is like making a cake without eggs – a bit challenging, but totally doable. There are other ways to show you’re good with money, like paying bills on time. On-time payments for your rent, utilities, or even your phone bill can show lenders you’re responsible. It’s all about consistency, like always remembering to take out the trash on garbage day.

How Long Does It Take to Establish a Good Credit History?

Building a solid credit history is like grown-up homework. It takes time and effort. Think of building your credit like growing a garden. You can’t plant seeds and expect them to grow right away. It might take months or even years to improve your credit score. Be patient. Keep making your payments on time, and your credit score will improve over time.

Empowering Your Financial Future Through Credit Building

When you’re in college, it might feel like you’re only focused on passing your next exam. However, college plays a big role in your financial future. By building a good credit profile now, you are setting yourself up to buy a car, own a home, or even start your own business one day. It’s like laying a strong foundation for a house—the stronger it is, the bigger your dreams can be.

The Long-Term Benefits of a Strong Credit History

Having a good credit score is like having a VIP pass in the world of finance. It opens doors.

Opportunities Afforded by Good Credit

Do you want a nice car or a comfortable home? Good credit can help you get these things. It acts like a special key that can give you lower interest rates and better loan terms. Good credit can also make you a more appealing choice for employers and landlords. Just think about walking into a car dealership or an apartment showing, feeling confident because your credit score is on your side.

The Role of Credit in Major Life Decisions

In life’s big moments, like buying your first home or starting a business, your credit score plays a starring role. Having a strong credit score can help you achieve your dreams. Having a good credit score shows lenders that you can be trusted to repay a loan. This makes it easier for them to approve your loan. Take care of your credit score, and it will help you achieve your goals.

In Conclusion: Building a Solid Financial Foundation in College

We’ve been talking about how to build your credit while you’re in college. It’s similar to learning to ride a bike, but instead of balancing on wheels, it’s about managing your money and making good choices. Going through this guide, you’ve seen how to start building a good rep with your credit, from getting that first credit card to keeping your payments smoother than your morning coffee. It’s all about planting seeds now that’ll grow into a big ol’ tree of financial stability later on. I recommend this book.

Summarizing the Journey to Credit Success

To keep it simple, here’s what you need to do: First, get a piece of plastic, like a secured credit card or become an authorized user on someone else’s credit card. Next, always pay your bills on time—no excuses. Don’t ignore your student loans; tackle them early. Remember, success takes time and planning for your future.

Key Takeaways on Credit Building for College Students

To improve your credit, start with a student credit card or by becoming an authorized user on someone else’s credit card with good credit. Always pay your bills on time; it really helps. You can also try credit-builder loans or use your rent payments to boost your credit score. Use a mix of strategies to improve your financial situation.

Next Steps in Your Financial Growth Path

Once you’ve nailed down those basics, it’s time to level up. Consider more ways to beef up your credit history, like checking out unsecured credit cards or getting more rewards from your spending. And hey, keep an eye on that credit score; it’s like your GPA but for money. Last but not least, remember the world doesn’t stand still, and neither should your credit strategies. Keep learning, growing, and keeping your eyes on the prize: a solid financial future.

Please note that as an Amazon Associate, we earn from qualifying purchases at no additional cost to you. That helps us in maintaining the website and staff.

Discover More Insights

Why the FOREVERPURE Premium Baby Towel Is a Must-Have

Why the FOREVERPURE Premium Baby Towel Is a Must-Have – because for the precious baby you want is the ultimate comfort!

The Classic White Shirt – A Chic Way To Style

Explore the enduring charm and unmatched versatility of the classic white shirt, a staple in every fashion-forward wardrobe. The classic white shirt represents a timeless essential in the realm of fashion, serving as a bridge between transient trends and enduring...

Women’s Square Neck Tank Top

Explore the allure of square neck tank tops, a versatile addition to any wardrobe that combines timeless style with modern flair.The women's square neck tank top is a fashion staple that effortlessly blends elegance and comfort. Its unique neckline offers a flattering...

Professional pedicure tool

A professional pedicure tool is something that can give you elegance and utmost health protection against something that is so overlooked!

10 Trendy Outfits for Spring 2025

10 Trendy Outfits for Spring 2025 – Spring 2025 is all about fresh colors, versatile layers, and mixing comfort with style.

Top 5 bedroom decor ideas for better sleep

Top 5 Bedroom Decor Ideas for Better Sleep Having trouble catching enough Z’s? Your bedroom setup might hold the key. A few strategic decor upgrades can turn your sleep space into a soothing sanctuary. Below are five sleep-friendly bedroom decor ideas – from budget...